7 Powers

Key Insights from 7 Powers by Hamilton Helmer

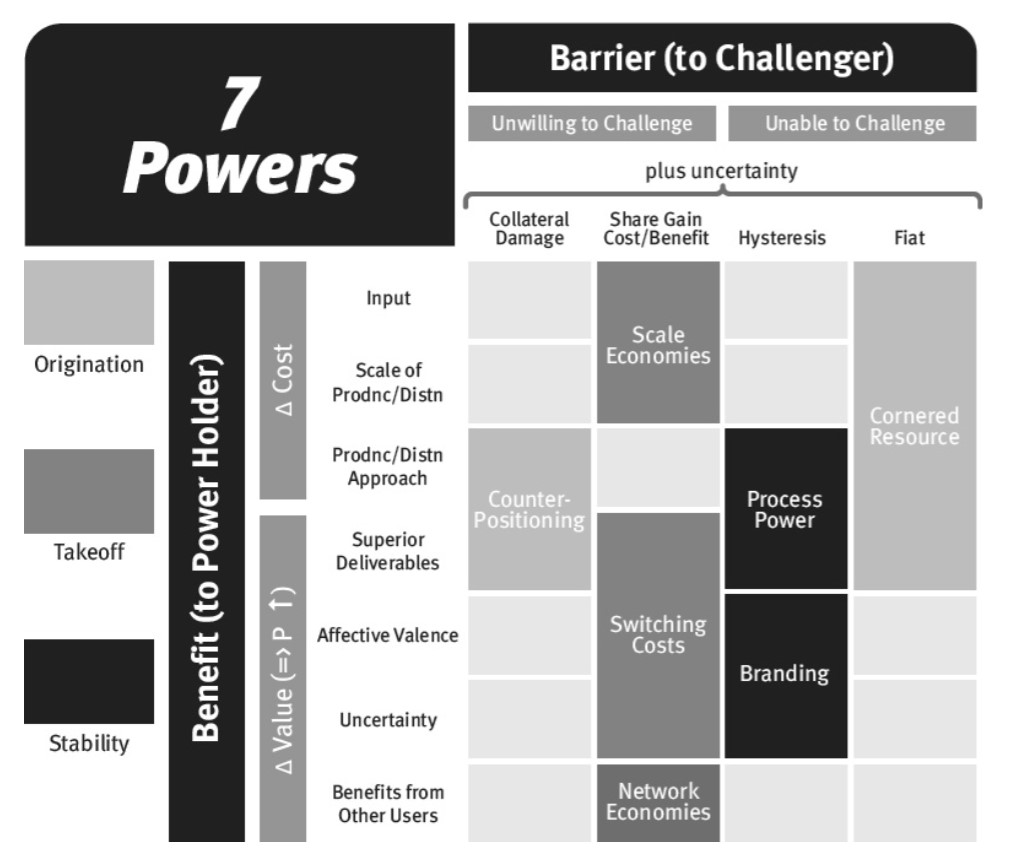

While the below graph might seem like the first one, it's actually a different chart that shows the intensity of the seven powers.

Definition of Strategy

Strategy is understood as the route to achieving and sustaining power in significant markets. It involves making crucial choices under uncertainty, which if wrong, can lead to severe repercussions for the business.

Execution vs. Strategy

Superb execution is essential for success, yet it's not sufficient alone. Strategic decision-making is crucial to guide and leverage day-to-day operations to achieve long-term objectives.

Power and its Importance

Power is the ability to generate persistent differential returns. It is central to the concept of strategy and involves conditions that sustain competitive advantages.

Static and Dynamic Aspects of Strategy

Strategy can be divided into statics (the current state, such as Intel’s durable value in microprocessors) and dynamics (historical evolution of that state).

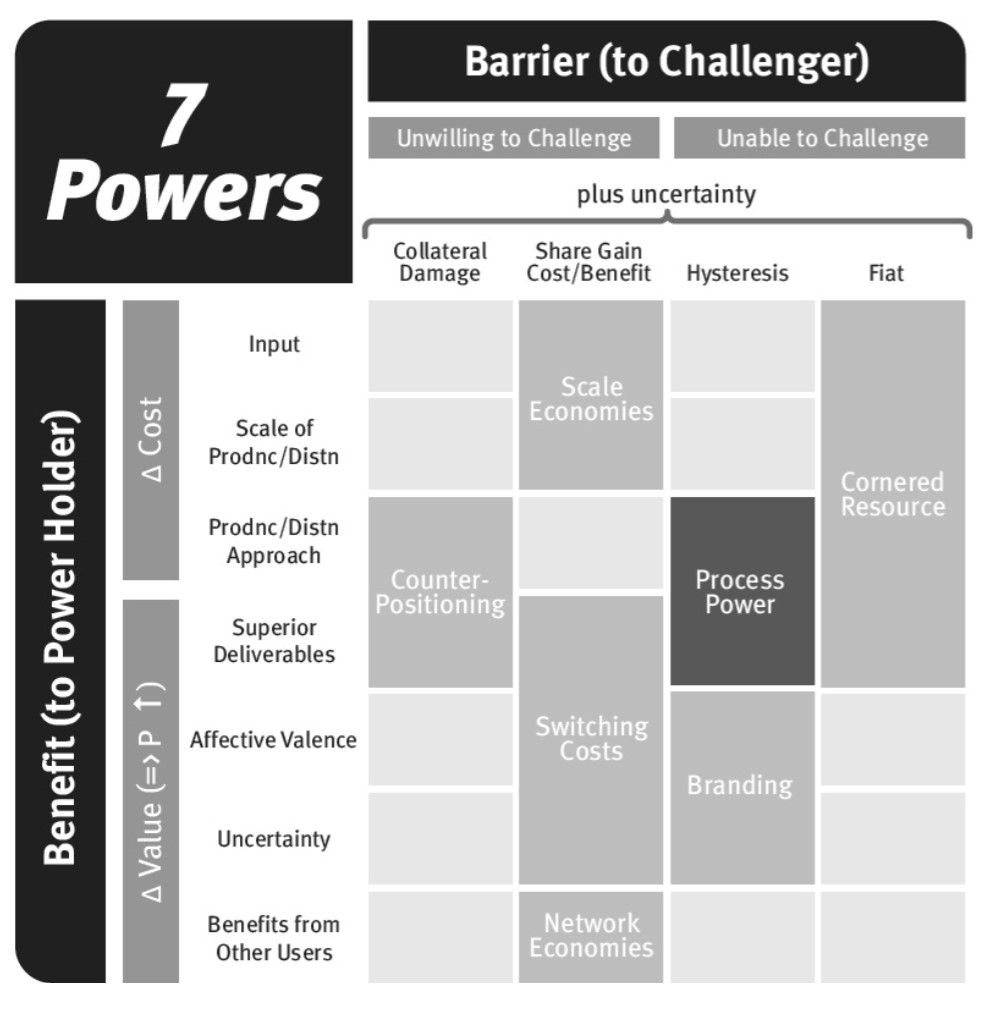

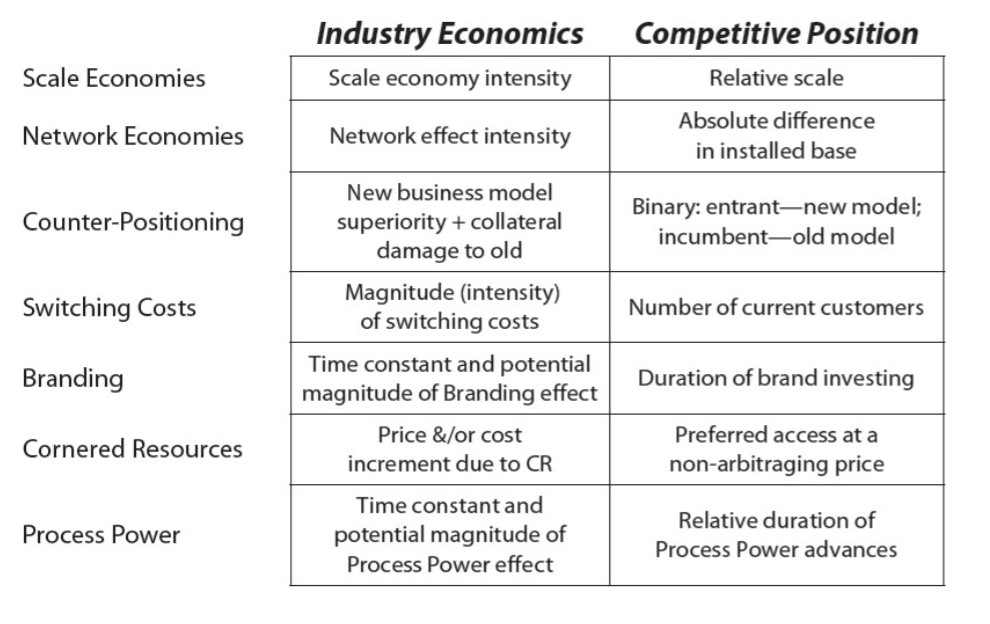

The Seven Powers Framework

Hamilton Helmer discusses seven distinct powers that businesses can harness to create a durable competitive advantage:

-

Scale Economies: This power involves achieving lower costs through increased scale, which is difficult for smaller competitors to match due to prohibitive cost structures.

-

Network Economies: The value of a product increases as more people use it. Dominant players can charge premium prices due to the added value from a larger user base.

-

Counter-Positioning: New market entrants can adopt a business model that incumbents cannot mimic without damaging their existing revenue structures, creating a barrier to competition.

-

Switching Costs: These arise when customers face costs to switch providers, allowing companies to charge higher prices and secure customer loyalty.